DeRISK Industrial 5.0

Cyber Risk Quantification and Management for OT Asset Owners

Don’t just quantify industrial cyber risk. Manage it.

The world’s only industrial cyber risk quantification and management platform that enables you to make continuously better cyber security investment decisions.

- How to quantify cyber risk for industrial or OT environments

- How to compare risk mitigation strategies

- An introduction to the DeRISK platform

- How to optimize your cybersecurity budget

About DeRISK

DeRISK by DeNexus sets a new standard in industrial cyber risk management. It’s the only solution to blend inside-out and outside-in cybersecurity signals with industry-specific insights to model and quantify cyber risk. DeRISK empowers executives to make evidence-based, data-driven cybersecurity investments and optimize the allocation of resources.

Your Benefits

Clear Quantification

Clear quantification of cyber risk in industrial environments and the total financial impact of a loss event.

DeNexus Knowledge Center

Access to a uniquely combined set of data from external sources and internal OT infrastructure.

Clear Business Case

A clear business case for prioritizing investments in risk mitigation strategies and insurance coverage.

Insight Foundation

A superior insight foundation for minimizing the risks of non-compliance and executive liability from potential cyber incidents.

Accurate Calculation

Dramatically more accurate calculation of the value at risk and expected financial loss leading to the optimization of cyber insurance coverage needed.

Clear Basis

A clear basis for comparing your exposure to cyber risk to that of your industry peers.

Accurate Forcasting

More accurate forecasting of direct and indirect cyber loss event impacts.

Quantify Impact

The ability to quantify the impact of your cyber risk management decisions on your risk tolerance and how that might change.

Easier Decision-making

A significantly improved ability to decide whether to accept, mitigate or transfer specific cyber risks.

Turnkey Executive Reports

Turnkey executive reports for easier collaboration with your CFO and the board of directors.

How does DeRISK work?

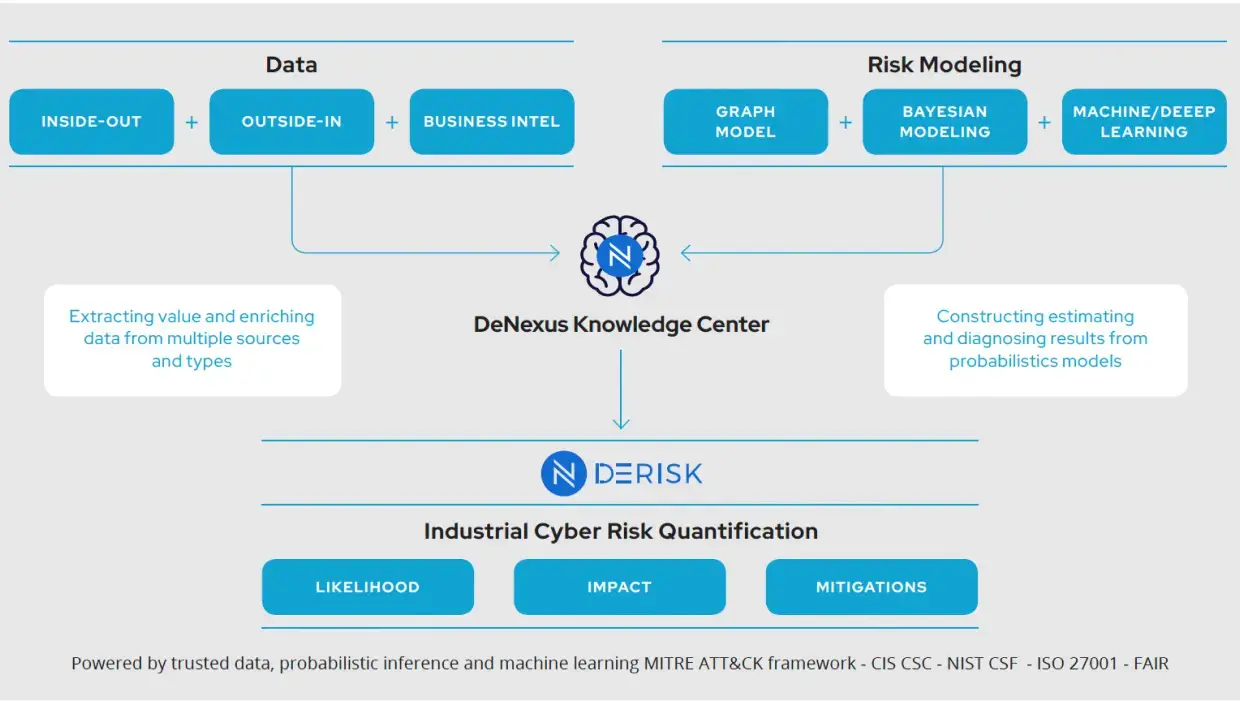

DeRISK continuously ingests external and internal OT cyber risk data. Using AI, ML, and Probabilistic Inference for normalization and modeling, the platform delivers significantly more accurate quantification outcomes than heuristic FAIR-derived models can provide on their own. These risk outcomes are auditable, repeatable, and provide clarity about the total financial impact of a potential cyber incident.

How does DeRISK compare to other industrial CRQM solutions?

DeRISK is the only industrial cyber risk quantification and management platform that:

- Utilizes more than 50 data sources and combines outside-in and inside-out data from proprietary set of cyber risk data, combining external and internal OT infrastructure data sources.

- Combines expert knowledge and empirical data to inform industrial executives about cyber risk and potential financial impact.

- Contextualizes cyber risk data with industry-specific processes.

- Improves cyber risk management decisions with superior data and risk mitigation recommendations.

- Continuously updates its data foundation to account for the rapidly evolving cyber threat landscape.

- Makes cyber risk insight extraction simple with an elegant, easy-to-navigate user interface.

Rising threats:

Cyber attacks against industrial targets are increasing in complexity, frequency and have financially damaging impacts. You need to be properly prepared and continuously informed. Sporadic reporting and decisions based on imprecise/incomplete data aren’t enough.

Strategic Opportunities:

Many organizations lack data-driven risk insights to inform their cyber risk management strategy. With better insights you can protect your operations optimally and allocate your cyber budget more intelligently.

Competitive advantage:

An improved ability to actively and dynamically reduce cyber risk exposure to improve your position compared with competitors, especially in the event of an industry-wide loss event.

Increasing compliance obligations:

Regulatory bodies and regulations are multiplying and becoming more onerous. The direct and indirect consequences of non-compliance are becoming more severe.

Rising cost of insurance:

Regularly assessing, monitoring, and adapting your coverage requirements is essential. Good cyber risk hygiene results in optimized coverage and premium.

Unpredictable macro-event impacts:

Global macro-events such as war, pandemics and extreme weather events are becoming more frequent. The impact on your cyber risk is real and needs to be understood.

Cost-saving:

Optimizing cyber risk exposure and insurance coverage creates savings that help you manage an inflationary or otherwise negative economic climate.

7 reasons NOW is the right time to invest in DeRISK

“With DeRisk we understand our cybersecurity posture and can prioritize risk reduction and mitigation actions based on actionable financial data.”

Ken YoungCEO, Apex Clean Energy

Customers & Partners

Solve Cyber Risk

Request a demo of the world’s first cyber risk quantification and management SaaS platform.

Request A Demo